Brexit - What I need to know

What you need to know regarding shipping after Brexit

As you will be aware, the UK left the EU on the 31st December 2020.

What will change?

The biggest change will be that all shipments will require a commercial/pro-forma invoice to be made. This will be required whether or not we make a trade deal with the EU.

Please note: Shipments from the UK to countries outside the EU are also affected by Brexit as the UK previously would have traded under EU trade deals with many countries and will now trade mainly under WTO rules until new trade deals are negotiated.

A free trade deal has been agreed by the Government and EU. No duties should be applied to your shipment after 1st January 2021. However, as you will not charge vat on your items to your EU customer and we will not charge you VAT on shipping, the recipient may be asked to pay VAT at the local rate on the contents and carriage. In addition, they will charge a disbursement fee which differs from country to country. These are not included in your quoted price which is for carriage only.

Please note that items that originate from outside the EU or UK with a value in excess of £125 (150 euros) can still attract duties in EU countries.

Please note that Imports from the EU to UK will also be subject to VAT, duties and customs fees which are not included in the quoted price which is for carriage only.

List of EU Disbursement fees and VAT rates to assist in calculating charges likely to be charged to the recipient.

| Country | Disbursement Fee | VAT rate % | ||

|---|---|---|---|---|

| MINIMUM charge Ex. VAT | GBP £ | % of value plus shipping | ||

| 18 euros | 15.52 | 3.00 | 20.00 | |

| 18 euros | 15.52 | 2.75 | 21.00 | |

| 30 BGN | 13.37 | 2.00 | 20.00 | |

| 20 euros | 17.24 | 2.00 | 25.00 | |

| 15 euros | 12.93 | 2.00 | 19.00 | |

| 450 CEK | 16.00 | 2.00 | 21.00 | |

| 150DKK | 17.50 | 2.00 | 25.00 | |

| 15 euros | 12.93 | 2.00 | 20.00 | |

| 20 euros | 17.24 | 5.00 | 24.00 | |

| 16 euros | 13.79 | 2.55 | 20.00 | |

| 25 euros | 21.55 | 3.00 | 19.00 | |

| 15 euros | 12.93 | 2.00 | 24.00 | |

| 7000 HUF | 16.20 | 2.50 | 27.00 | |

| 18 euros | 15.52 | 2.00 | 21.00 | |

| 18 euros | 15.52 | 2.00 | 22.00 | |

| 15 euros | 12.93 | 2.00 | 21.00 | |

| 15 euros | 12.93 | 2.00 | 21.00 | |

| 15 euros | 12.93 | 3.00 | 17.00 | |

| 15 euros | 12.93 | 2.00 | 18.00 | |

| 20 euros | 17.24 | 2.00 | 21.00 | |

| 80 zloty | 15.80 | 2.50 | 23.00 | |

| 30.30 euros | 27.00 | 23.00 | ||

| 75 LEI | 13.15 | 2.00 | 19.00 | |

| 18 euros | 15.52 | 2.00 | 20.00 | |

| 23 euros | 19.82 | 2.00 | 22.00 | |

| 20 euros | 17.24 | 2.00 | 21.00 | |

| 300 SEK | 22.44 | 3.00 | 25.00 | |

Example of expected charges

Parcel to Italy

Item value £80.00

shipping cost £16.95

Total £96.95

payable by receiver;

Vat at 22% on £96.95 = £21.33

Disbursement fee £12.03 plus vat @22% = £14.68

Total payable by receiver = £36.01 (approximately 40 euros).

Please note this is guide only based on the information we have currently and customs may add other fees at their discretion. However, if they differ much from this example the receiver should query with their local customs authority. We cannot assist in disputes regarding duties charged abroad.

In the event that the recipient refuses to pay the customs charges the parcel will have to be returned at your cost or destroyed. Worldwide Parcel Services Ltd are not liable for any VAT/duties/admin fees levied by customs.

What items are prohibited or restricted into the EU?

As well as the items listed in our general "Restricted and Prohibited items list" there are many others restricted into the EU.

Please click here to view the commodity codes that are restricted from shipping.

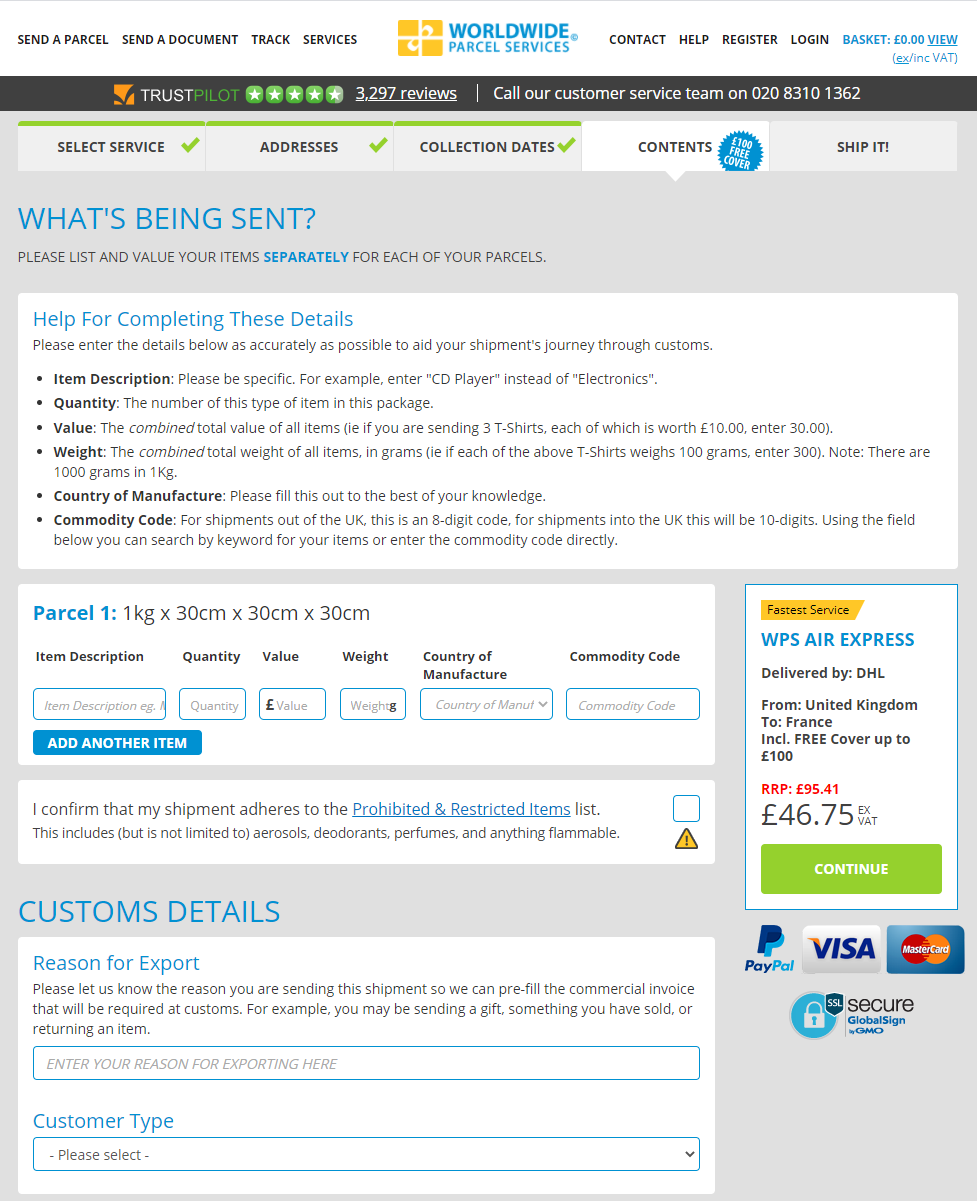

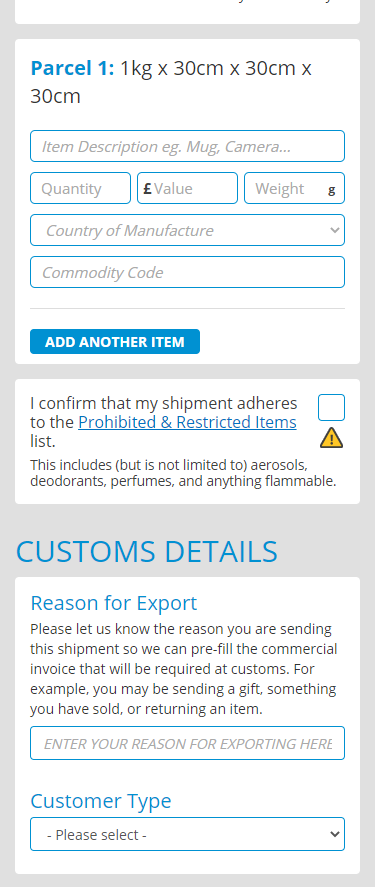

How is booking affected by Brexit on your website?

The main change will be that when you arrive at the contents and value page, instead of just entering, say “clothes value £100” you will need to itemise, i.e., “5 pairs of trousers £50” and “5 shirts” £50. You will also need the commodity/harmonising code for your items. These will need to be entered on separate lines as shown in the screenshot from our website below

Will I need to print the commercial/pro-forma invoice?

You should not need to as our website will automatically make this and send it electronically to the courier. If you are a business you will need to enter your EORI number when booking.

Will my labels change?

DHL labels will be sent to you as normal but you will notice that road service will state “ESI” instead of “ESU” and Air service will state “WPX” instead of “ECX”.

What about VAT?

You will not be charged VAT by us on your carriage for shipments to the EU. This will be payable at the destination countries rate by the receiver.

Will there be delays?

It is expected that there may be delays at ports immediately after Brexit as the new systems roll out, so please allow extra time for deliveries to be made.

Can I ship the same items to the EU as before Brexit?

Yes but with some exceptions. Please pay special attention when shipping food or plants as they are subject to numerous rules and regulations and are particularly problematic.

Northern Ireland

Northern Ireland is treated differently from the rest of the UK and parcels to the EU from Northern Ireland are shipped on pre-Brexit terms, VAT is charged on carriage, no customs paperwork is required and the recipient will not be asked for customs charges.

If you have any queries regarding shipping after Brexit please contact us at [email protected].

Customer Service: 020 8310 1362

Customer Service: 020 8310 1362